This in-depth Heymondo review determines if it’s the right travel insurance for your 2026 trips, especially to destinations like Thailand. Known for its high medical limits and user-friendly app, Heymondo’s coverage often surpasses standard credit card insurance.

To help you decide, we have analyzed their policies, pricing, and customer reviews to provide a clear, objective verdict.

Our Heymondo Review in Brief

Heymondo is an excellent option for travelers who want very high medical coverage and a fully digital, stress-free insurance experience.

- ✅ Ideal for: Travelers of all ages (up to 74) seeking maximum medical coverage, and families.

- ✅ Main strength: No out-of-pocket medical payments and a very practical mobile app with 24/7 assistance.

- ✅ Key policies: Travel Top (the most balanced) and Travel Premium (for maximum coverage).

- ⭐ Trustpilot rating:

4.1 / 5 (from 2.9K+ reviews)

💡 Reader deal: a -5% discount is automatically applied when using our partner links.

Analysis of Heymondo’s Plans for a Trip to Thailand

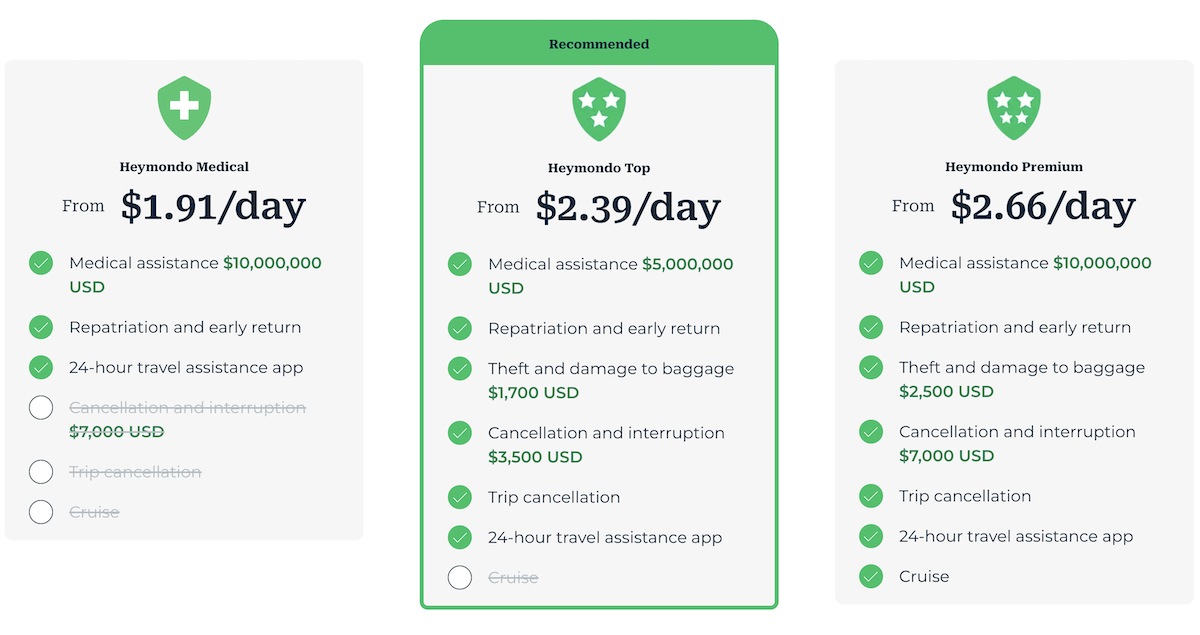

Heymondo, which acts as a broker, relies on the solid network of IMA (Inter Mutuelle Assistance) for its policies in France. The short-term insurance (up to 90 days) is available in three main plans to suit different needs and budgets.

| Criteria | Heymondo Medical | Heymondo Top | Heymondo Premium |

|---|---|---|---|

| Daily Rate | from $1.91 | from $2.39 | from $2.66 |

| Max Medical Coverage* | Up to $10,000,000 | Up to $5,000,000 | Up to $10,000,000 |

| Civil Liability | Up to $60,000 (depending on residence and policy) | ||

| Baggage Deductible | Yes, depending on policy (sub-limits per item may apply) | ||

| Cancellation Limit | Not Included | Up to $3,500 | Up to $7,000 |

| Electronics Option | Optional (custom limits with sub-limits per item) | ||

| Adventure Sports | Included (specific activities and thresholds apply) | ||

Instant quote · No payment required

*Coverage limits, deductibles, and conditions vary depending on your country of residence, destination, age, and selected options. Only the terms shown in your personal quote and policy wording are legally binding.

- Important Note: Amounts and coverage may vary depending on age, destination, and chosen options. Only the General and Specific Terms and Conditions of your Heymondo quote are legally binding.

- Cancellation: Heymondo covers up to 42 reasons for cancellation, but the limits and subscription deadlines vary depending on the product (short stay, annual, etc.).

- Civil Liability: The limit may be higher (e.g., €100,000) on the annual multi-trip insurance. For short stays, the liability coverage is often lower than some competitors; check if the limit is suitable for your needs.

Other Heymondo Policies to Know

Long-Stay Insurance (over 90 days)

Ideal for a single trip of more than 3 months (like a working holiday visa, a round-the-world trip, or a long sabbatical). This flexible and renewable plan is perfect for long-term travelers, but note that it is generally reserved for those under 40.

Annual Multi-Trip Insurance

Perfect if you take several trips throughout the year. This cost-effective solution covers all your stays of up to 90 days each and is ideal for frequent travelers, though it is not suitable for a single long trip.

How Does Claim Processing Work in Case of a Problem?

One of Heymondo’s biggest advantages is the simplicity of its claims process. Here is how it works in practice:

- Contact Assistance: Via the Heymondo mobile app (through a free call or chat), you contact the 24/7 assistance team.

- Guidance: An advisor directs you to a partner hospital or clinic suitable for your situation.

- Direct Billing: Heymondo arranges payment directly with the medical facility. You have nothing to pay out-of-pocket for covered expenses, which is a major relief in a stressful situation.

Heymondo Insurance for Thailand: Pros and Cons

👍 What We Like About Heymondo

- Excellent coverage-to-price ratio: High medical limits and comprehensive benefits (cancellation, adventure sports) are included for a very competitive daily rate.

- No out-of-pocket payments: In case of hospitalization or significant medical expenses, Heymondo assistance pays the healthcare facility directly.

- The mobile app: This is a real highlight. It allows you to manage claims, access a 24/7 medical chat, and make free emergency calls over the internet.

- Attractive discounts: Heymondo offers preferential rates for families (15% discount) and groups.

- COVID-19 coverage: All plans include medical expenses, repatriation, and trip extension costs related to a positive PCR test at the destination.

🤔 Points to Watch

- Possible deductible on baggage: Although medical expenses are deductible-free, a small deductible may apply to other benefits like baggage coverage. Be sure to check this point in your policy’s terms.

- Electronics option: Coverage for valuable electronic equipment (laptops, cameras) is usually an add-on option to increase the basic limits.

- Age limit: Long-stay insurance is limited to those under 40, and standard insurance to those under 74, which may exclude some senior travelers.

Get Your Personalized Heymondo Quote

The best way to know if Heymondo is right for you is to get a quote. It’s free, fast, and non-binding.

Compare Plans and Get a Quote

📋 Checklist Before You Buy

Before finalizing your choice, take a minute to check these essential points in your policy’s terms. This is what separates good coverage from the perfect coverage for your trip.

- Medical expense limits

- Deductible amount (baggage, etc.)

- List of sports covered by default

- Cancellation coverage limit

- Electronics coverage

- Accepted reasons for cancellation

- Waiting period if already traveling

- Specific age limits

Heymondo Review: Our Final Verdict

Should you choose Heymondo for your trip to Thailand? Our review of Heymondo insurance is very positive. It is an excellent choice for the vast majority of travelers.

If the goal is to get the highest reimbursement limits, very comprehensive benefits included by default, and a 100% digital experience, Heymondo is probably the best option. Families will also benefit from dedicated discounts.

To explore all of Chapka’s offers (including long stays), see the complete review of Chapka insurance. To broaden your choice even further, browse the comparison of insurance for Thailand.