This ACS insurance review is dedicated to travelers heading to Thailand. If you’re looking for a clear, objective analysis, you’re in the right place. ACS has carved out a solid reputation, especially among young travelers, thanks to flexible and highly competitive plans. But is it the right choice for your trip?

This page breaks down their policies, coverage, and customer feedback to help you decide.

Our ACS Insurance Review for Thailand: In Brief

ACS is the smart choice for very specific types of travelers.

-

- ✅ Ideal for: Travelers under 40, tight budgets.

- ✅ Main strength: Excellent value for money.

- ✅ Key policies: Globe Partner (ultra-economical) and Globe Traveller (flexible multi-risk).

- ⭐ Trustpilot score: 4.4 / 5 (from +700 reviews).

Analysis of ACS Plans for a Trip to Thailand

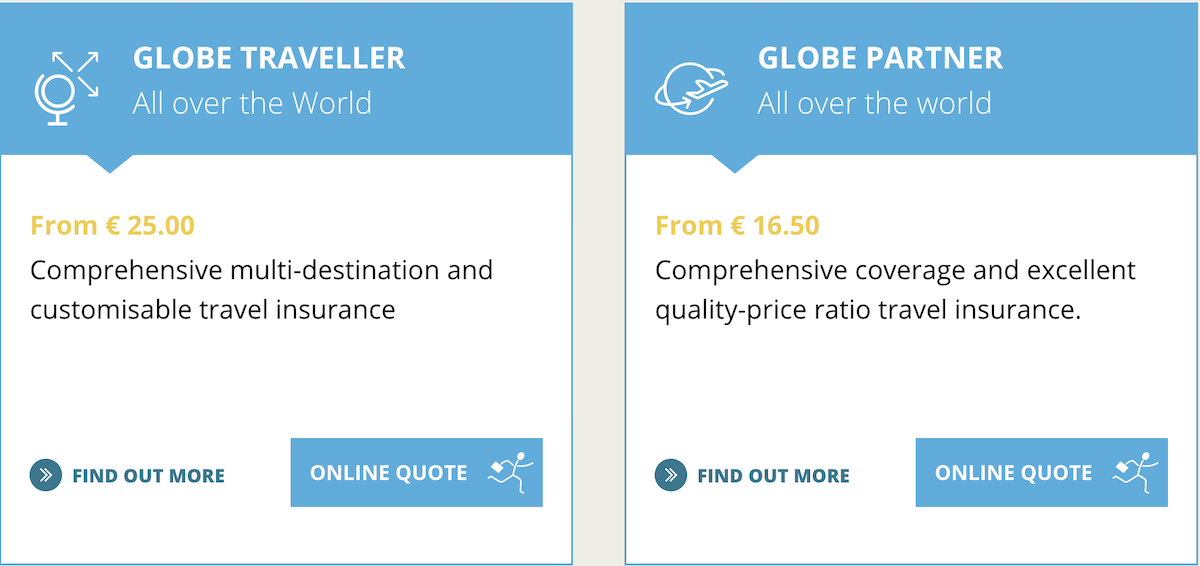

To form a solid opinion on ACS insurance for Thailand, it’s crucial to understand their two main policies, Globe Partner and Globe Traveller, which cater to very different needs.

| Criteria | ACS Globe Partner | ACS Globe Traveller |

|---|---|---|

| Ideal Profile | Travelers under 40, tight budget | All ages, families, demanding travelers |

| Medical Limit | Up to €300,000 | Choice of: €150k, €300k, or €500k |

| Cancellation Insurance | ❌ No | ✅ Yes (optional) |

| Baggage Insurance | ❌ No | ✅ Yes (included) |

| Flexibility | Single plan | Highly customizable |

| Price (indicative) | From €29.50 for 15 days | Higher, depending on options |

1. ACS Globe Partner: The Budget-Friendly Option for Under-40s

The Globe Partner policy is undoubtedly one of the most competitive on the market for short stays. It gets straight to the point by offering solid protection where it matters most, especially for unexpected medical expenses. It’s an excellent alternative for those on a tight budget who might otherwise be tempted to rely on their credit card’s basic protection. However, as our guide on credit card insurance demonstrates, this protection is often insufficient.

- Target audience: Students, young travelers, and “backpackers” under 40 traveling for less than 90 days.

- Medical coverage limit: Up to €300,000, which is very comfortable for most health issues in Thailand.

- Included coverage: Hospitalization, consultations, medical repatriation, civil liability.

- The key strength: A very competitive starting price. For example, a 15-day stay in Thailand costs €29.50.

2. ACS Globe Traveller: The Flexible, Multi-Risk Plan

For those looking for more coverage or who don’t fit the criteria for Globe Partner, the Globe Traveller policy is the solution. It is designed as a comprehensive and modular multi-risk insurance, for travel anywhere in the world, including for a round-the-world trip lasting up to 12 months.

- Target audience: Travelers of all ages (up to 65), families, and those who want tailor-made options.

- Flexibility: You can choose your reimbursement limits and add options according to your needs.

- Notable coverage and options: Baggage insurance (included), trip cancellation guarantee (optional), coverage for sports equipment (optional).

- The family bonus: ACS offers a 10% discount for families (of 3 or more people), making this offer very attractive.

- The tech bonus: A VPN service is included with the subscription, a real plus for securing your internet connection in Thailand.

Get a Quote for Globe Traveller

ACS Thailand Insurance: Pros and Cons

No insurance is perfect for everyone. Here is our objective analysis to help you weigh the pros and cons and finalize your review of ACS insurance for Thailand.

👍 What We Like About ACS

- The price: This is their key selling point. It’s hard to find cheaper for such a serious level of coverage.

- Tailored assistance for each policy: This is a major advantage. The Globe Traveller policy benefits from a partner in Bangkok (Euro-Center) with a Thai assistance number available 24/7. For Globe Partner, assistance is managed from France but relies on a network of local correspondents to intervene effectively on-site. In both cases, you have help in an emergency.

- Clarity: The policies are easy to understand, without excessive jargon.

- Flexibility: The Globe Traveller policy allows you to pay only for the coverage you really need.

🤔 Points to Consider

- The budget positioning: The Globe Partner policy is very competitive but includes neither baggage nor cancellation insurance. For a more comprehensive option, check our Chapka Insurance review.

- The medical coverage limits: While sufficient for Thailand, the limits may be tight for destinations like the USA/Canada. For higher limits, insurers like Heymondo may be a better option.

- Direct billing upon request: For minor consultations, you will have to advance the costs. However, in case of hospitalization for more than 24 hours, direct billing is possible. It is then imperative to contact the assistance platform before incurring expenses so that they can arrange payment with the hospital.

Ready to find out if ACS is right for you?

Get your personalized quote in less than a minute. It’s free and non-binding.

Conclusion of Our ACS Insurance Review

Should you choose ACS for your trip to Thailand? Our review of ACS insurance for Thailand is a big yes, provided you fit the right profile.

ACS is not designed to be the most comprehensive insurance on the market, but within its target segment, it delivers exactly what it promises.

If you are under 40 and your budget is your priority, the Globe Partner policy is almost unbeatable. If you are a family or an older traveler looking for flexibility, the Globe Traveller is an excellent alternative to consider. ACS may not be the insurance with the highest coverage limits, but it offers solid, reliable, and transparent coverage at a price that allows you to allocate more of your budget to what’s essential: enjoying your trip.

If you wish to compare this offer with other market leaders, such as Chapka insurance, which is an excellent option for long stays, we invite you to read our complete guide to insurance for Thailand.