How did Thailand’s tourism industry really perform in 2025? The official year-end numbers reveal a complex picture: while the country welcomed nearly 33 million visitors, shifting travel trends and economic realities have reshaped the landscape. This data report dives into the final Thailand tourist arrivals 2025 with a clear, unsponsored view of visitor demographics, monthly patterns, and revenue data. Whether you’re an analyst, journalist, or traveler, these insights clarify the dynamics shaping the Kingdom’s tourism landscape into 2026. For a broader overview, see our main guide on Thailand tourism trends.

Key Highlights: Full Year 2025

- Total Arrivals 2025: 32,974,321 (Official Final).

- YoY Trend: −7.23% vs 2024.

- Top Market 2025: Malaysia (4.52 M) regained the #1 spot, surpassing China (4.47 M).

- Foreign Tourism Revenue: ~1,530 B THB (below the government target).

- Peak Month: January (3.7 M arrivals).

- Note: Final data released Jan 6, 2026.

Key Figures: 2025 Year-in-Review

| Indicator | Value | Note |

|---|---|---|

| International Arrivals | 32,974,321 | Jan 1–Dec 31, 2025 (Final) |

| Top Source Market | Malaysia: 4,520,000 | Full Year 2025 |

| Foreign Tourism Revenue | ≈ 1,530,000 M THB | Missed 2025 target |

| Bangkok Trend | Mature / Stable | Slight YoY decline in spend |

Source: Ministry of Tourism and Sports, official release 06/01/2026.

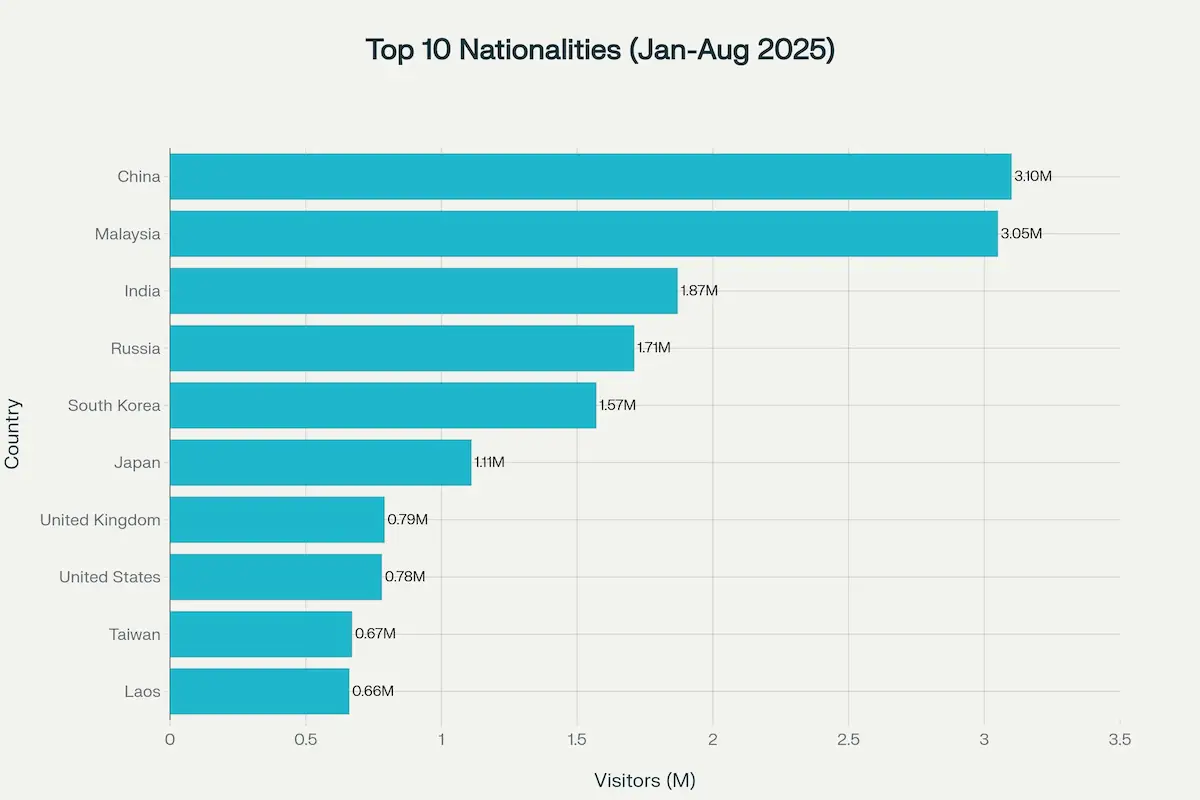

Thailand Tourist Arrivals 2025: Top 5 Nationalities (Final)

| Rank | Nationality | Total 2025 | Comments |

|---|---|---|---|

| 1 | Malaysia | 4,520,000 | Surged in Q4 (holidays), reclaiming top spot |

| 2 | China | 4,470,000 | Strong but slower growth than expected |

| 3 | India | 2,490,000 | Consistent growth, high wedding/family travel |

| 4 | Russian Federation | 1,900,000 | Strong high-season performance (Phuket) |

| 5 | South Korea | 1,560,000 | Consistent short-haul leisure market |

Source: Ministry of Tourism and Sports 2025 Final Report.

Top 10 Chart (Context)

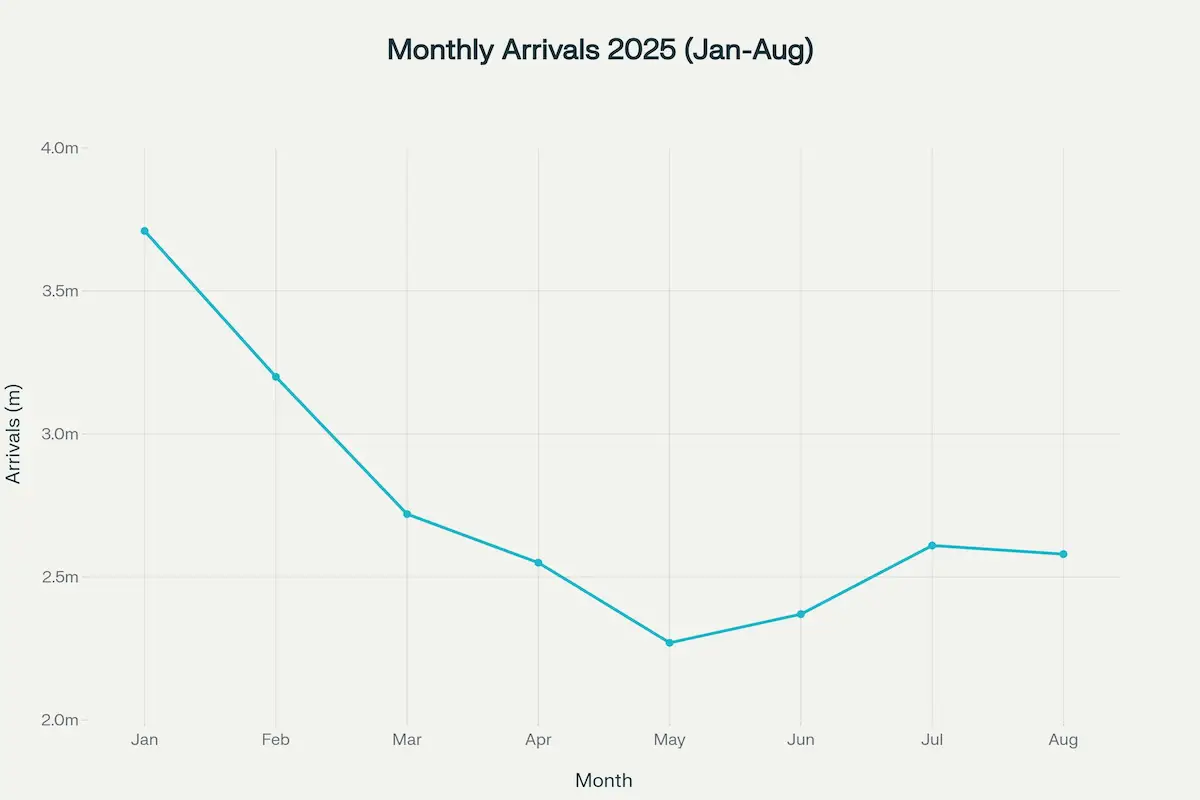

2025 Seasonality (Monthly Overview)

The year 2025 followed a classic “U-shaped” curve: a very strong start (Jan-Feb), a significant dip during the low season (May-Jun), and a robust recovery in Q4, particularly in November and December.

Focus on Q4 2025 (High Season)

- November: ~2.91 M arrivals (Start of high season).

- December: ~3.32 M arrivals (Peak holiday travel).

- Trend: The end-of-year surge helped push the total near the 33M mark, driven by long-haul markets (Europe/Russia) escaping winter and regional holidays (Malaysia/Singapore).

Monthly Arrivals 2025 (Full Year)

| Month | 2025 Arrivals | Comment |

|---|---|---|

| January | 3,709,100 | Yearly Peak (Chinese New Year) |

| February | 3,119,450 | Strong High Season |

| March | 2,720,460 | Transition period |

| April | 2,547,120 | Songkran Festival boost |

| May | 2,266,570 | Low season bottom |

| June | 2,322,770 | Gradual recovery |

| July | 2,610,370 | Summer holiday peak |

| August | 2,583,640 | Steady summer flows |

| September | 2,235,850 | Pre-Golden Week dip |

| October | 2,573,740 | High season kickoff |

| November | 2,910,210 | Loy Krathong / Winter start |

| December | ~3,320,000 | Christmas / NYE Peak (Est.) |

Source: Ministry of Tourism and Sports.

Primary source for monthly series: Bank of Thailand – Tourism Indicators (EC_EI_028_S2).

Revenue by Province/Region (Trends)

Throughout 2025, a geographic rebalancing became evident. While Bangkok and Phuket remained the revenue giants, their growth slowed due to saturation and price competition. In contrast, Northern provinces like Chiang Mai saw double-digit growth in revenue, driven by cultural tourism and digital nomads seeking value.

| Area/Province | 2025 Trend Signal | Key Driver |

|---|---|---|

| Bangkok | Stable / Slight Decline | Lower average spending per day |

| Phuket | Competitive Pressure | High prices pushing tourists to Krabi/Khao Lak |

| Pattaya (Chonburi) | Recovery Struggle | Dependent on specific mass markets |

| Chiang Mai | Strong Growth | Cultural appeal + Direct flights |

| Chiang Rai | Niche Growth | Nature/Culture travelers |

What This Means for 2026 Travel Planning

- Value for Money: With Bangkok and Phuket prices remaining high despite softer demand, look to the North (Chiang Mai) or secondary islands (Trang, Koh Lanta) for better value in 2026.

- Timing Matters: The “shoulder seasons” (May/June and Sep/Oct) offer significantly lower crowds, as confirmed by the 2025 low-season dip. See real crowd levels through authentic Thailand travel videos.

- Emerging Hubs: The data clearly shows a shift towards cultural and nature-based tourism in the North—a trend likely to accelerate in 2026.

For emergency contacts and practical tips, see the Thailand safety guide.

Thailand Tourism Statistics 2025: Downloads and Reuse

These tables may be reused in third‑party analyses with attribution to the official source and update date. For your own materials, convert to CSV/PNG and cite this page.

Credits and Sources: Ministry of Tourism and Sports (Final 2025 Statistics Report, released Jan 6, 2026); Bank of Thailand Economic Indicators. Data finalized as of January 6, 2026. Visual elements are editorial summaries. Writing and formatting: Portail Asie — 2025 Year-in-Review.

🔄 Last updated on January 16, 2026