Finding yourself with a blocked bank account in Vietnam is stressful for expats and travelers. This guide explains why it happens and how to unblock your funds quickly, like the recent Thailand banking issues.

Why is Your Bank Account Blocked in Vietnam?

Far from being an arbitrary decision, the account freeze is part of an initiative by the State Bank of Vietnam (SBV) to close over 86 million accounts deemed “inactive” or at risk. The objectives are clear and aim to sanitize the country’s financial ecosystem.

1. Fighting Fraud and “Junk Accounts”

The primary goal is to dismantle fraud networks that use “mule accounts.” A frozen bank account in Vietnam can be the result of suspected inactivity, making it potentially vulnerable for use by criminals to launder money or receive funds from scams.

2. Strengthening Security and Know Your Customer (KYC)

Vietnamese authorities are reinforcing “Know Your Customer” (KYC) procedures. If your personal information (passport, address, phone number) is not up-to-date, the bank may block your account as a precautionary measure. This is to ensure that every account is correctly linked to an identified individual or legal entity.

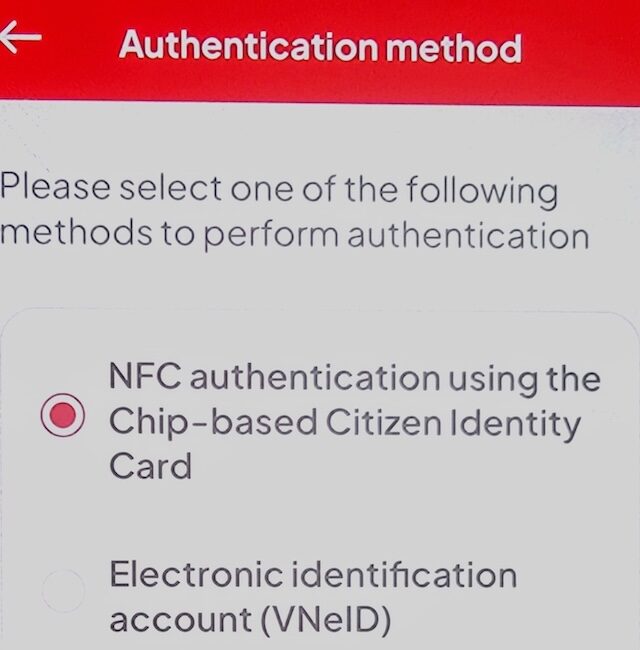

3. The New Requirement: Biometric Authentication

The turning point of this reform is the introduction of biometric authentication (facial scan, fingerprints). Governed by Decision No. 2345/QD-NHNN, this measure has become mandatory for many transactions. As confirmed by official sources, foreigners are advised to visit bank branches for this verification, since they often lack chip-based Vietnamese ID cards. An account whose holder has not completed this new verification is automatically considered non-compliant and is at risk of being blocked.

Is My Account at Risk? Profiles Under Scrutiny

This is the question on everyone’s mind. Your Vietnamese bank account is most at risk if you match one of these profiles — especially common for expats and long-term travelers.

Inactive and “Frozen” Accounts

If you have not made any transactions for a long period, your account is on the front line. Major state-owned banks like BIDV, Vietcombank, and Agribank have already started actively locking these “dormant” accounts.

The Case for Foreigners: Expats and Travelers

Foreigners are particularly affected. An account opened with an old visa, an outdated address, or a deactivated local phone number are all red flags. If you are unable to justify your current status, the risk of having your bank account locked is very high.

✈️ Travel with Peace of Mind

The unexpected can happen quickly. A simple consultation or hospitalization in Vietnam can cost thousands of dollars. Good travel insurance covers your medical expenses, repatriation, and provides assistance if problems arise. It’s the essential step for a worry-free stay.

Exclusive Offer: By using the links in our guide, get up to 5% instant discount on your policy.

A Practical Guide for a Blocked Bank Account in Vietnam

If you find yourself in this situation, it is crucial to act quickly and methodically. This checklist summarizes the key steps to take:

| Step | Action | Key Documents / Info Needed |

|---|---|---|

| 1 | Contact Your Bank Immediately | Phone number or email of your branch |

| 2 | Visit the Branch In Person | Valid Passport, Visa/Residence Permit, Proof of Address |

| 3 | Perform Biometric Verification | Be ready for a facial scan or fingerprinting on-site |

| 4 | Follow Up if Abroad | Discuss remote options; be prepared for account closure and SWIFT transfer |

What If You Are Not in Vietnam?

This is the most complex scenario, as highlighted in Step 4 of the checklist. Most banks require a physical presence. Contact your branch immediately to explain your situation. If no remote solution is possible, the bank will typically offer to close the account and transfer the remaining balance to another account in your name, which can incur significant fees (closure fees, international SWIFT transfer fees, etc.).

What Are the Alternatives if Your Account Remains Blocked?

Faced with these difficulties, many expats are turning to more flexible alternative solutions:

- Wise (formerly TransferWise): Ideal for holding a multi-currency account and making low-cost international transfers.

- Revolut: Another convenient neobank for managing multiple currencies and paying in Vietnam with competitive exchange rates.

These services are reliable backup solutions for managing your daily finances.

How to Avoid Having Your Account Blocked in the Future

For those who have not yet been affected, proactivity is the best protection. Here are the best practices to adopt to secure your account:

- Use your account, even for small amounts: A simple transfer or payment from time to time can be enough to show that the account is active.

- Update your personal information: Changed your visa, passport, or phone number? Inform your bank immediately.

- Complete the biometric identity verification: Don’t wait for the bank to ask you. If you are in the country, go to a branch to complete this essential update.

Proactivity: The Key to Protecting Your Funds

While having your bank account blocked in Vietnam is a destabilizing experience, it’s the direct result of a necessary security upgrade for the country’s financial system. For expats and travelers, the key takeaway is proactivity. Regularly check your account status and keep your personal information updated, especially your biometric data. Don’t forget your Vietnam travel insurance as an additional safety net for financial emergencies. By anticipating these requirements, you can avoid the stress of a sudden freeze and ensure your funds remain secure.

Frequently Asked Questions (FAQ)

Why was my bank account blocked in Vietnam?

Your account was likely blocked due to prolonged inactivity, outdated personal information, or because you have not completed the new biometric authentication procedure required by Vietnamese banks.

As a foreigner, am I at a higher risk of having my account blocked?

Yes, the risk is higher because changes in visa, address, or phone number are more frequent. Banks are particularly vigilant with accounts where the holder cannot justify a clear and up-to-date residency status.

Will I lose my money if my account is blocked?

No. A block is a restrictive measure, not a seizure. Your money remains your property. However, you will need to follow a strict procedure, often in person, to access it again or to close the account and retrieve your balance.

I am not in Vietnam, how can I unblock my account?

This is very difficult. Physical presence is almost always required. Contact your branch immediately by phone. The most likely solution will be to close the account and transfer your balance to another international account.

🔄 Last updated on January 5, 2026