Finding your Bangkok Bank account frozen mid-transaction is stressful. This guide explains why it happens under new Thai banking rules and how to fix it quickly.

The Context: A General Tightening of Banking Rules in Thailand

Since early 2025, Bangkok Bank, Thailand’s largest bank, has begun enforcing stricter rules for accounts held by foreigners. This decision is part of a broader regional effort to strengthen cybersecurity, mirroring the situation for those with a blocked bank account in Vietnam. This national initiative aims to actively combat financial fraud, money laundering, and online scams that use local bank accounts. Other commercial banks are expected to follow suit, if they haven’t already.

The 4 Reasons Your Bangkok Bank Account Was Frozen

1. Crackdown on Fraud and “Mule Accounts”

The primary motivation for the banks is to prevent the use of “mule accounts”. These are accounts opened by individuals, often tourists, and then used by criminal networks to launder money or receive funds from scams. A major scandal in May 2025, where bank employees were arrested for opening accounts for scammers, has accelerated the enforcement of these measures.

2. Your Visa Type No Longer Meets the Criteria

This is the most common reason. Previously, it was possible to open an account with a simple tourist visa. Now, the rules have changed: Bangkok Bank stopped opening new accounts for tourists in January 2025. Worse, it is freezing existing accounts that are not linked to a long-term visa. Tourist visas, including the new 180-day Destination Thailand Visa (DTV), are no longer considered sufficient. To keep or open an account, you must now hold:

- A Non-Immigrant Visa (for work, study, etc.)

- A Retirement Visa

- Proof of marriage to a Thai citizen

- A property title in Thailand

| Visa Type | Account Authorized? | Notes |

|---|---|---|

| Tourist Visa | ❌ Frozen / Denied | Including DTV (180 days), not accepted since 2025 |

| Non-Immigrant Visa (Work/Study) | ✅ Yes | Account accessible if documents are up-to-date |

| Retirement Visa | ✅ Yes | Requires proof of regular income or minimum deposit |

| Marriage Visa | ✅ Yes | Proof of marriage required |

| Property Ownership in Thailand | ✅ Yes | Can justify a residential account |

3. Lack of Identity Verification (KYC – Know Your Customer)

Just like with the new Thai Digital Arrival Card, banks are applying “Know Your Customer” (KYC) procedures more rigorously, in line with international standards. If your personal information (passport, address, phone number) is not up-to-date, the bank may freeze your account as a precaution. You may be asked to visit a branch for a new identity verification, sometimes involving a biometric facial scan. Additionally, a new law requires bank accounts to be linked to a SIM card registered in the exact name of the account holder.

4. International Pressure and Sanctions

Although the new rules apply to all nationalities, some reports have highlighted a large number of Russian nationals being affected, potentially linked to international sanctions that complicate financial transactions. However, it is clear that the measure is global and affects any foreigner who does not meet the new visa criteria.

🩺 Travel with Peace of Mind

- The unexpected can happen quickly. A simple consultation or hospitalization in Thailand can cost thousands of dollars. Good travel insurance covers your medical expenses, repatriation, and provides assistance if problems arise. It’s the essential step for a worry-free stay.

- Exclusive Offer: By using the links in our guide, the insurance providers we recommend offer you up to a 5% instant discount on your policy.

What to Do if Your Bangkok Bank Account is Frozen

- Don’t panic: A freeze does not necessarily mean permanent closure or loss of your funds.

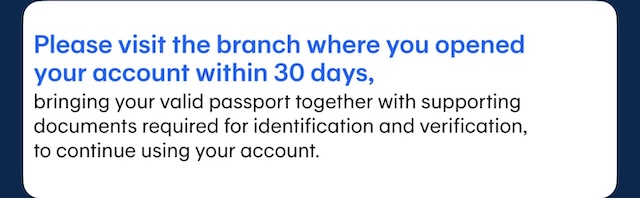

- Contact your bank: Call or go directly to the branch where you opened your account. This is often a non-negotiable requirement.

- Prepare your documents: Bring your passport, your bank book, and proof of your current visa.

- Complete the verification: Be prepared to update your information and perform an in-person identity verification.

📌 What to Do if You’re Not in Thailand?

This is a common and problematic situation. Here are the possible scenarios:- You have a representative in Thailand: No options, verification must be done in person.

- You are abroad and your account is frozen: Contact your branch by phone. Some may allow unblocking after you send documents certified by the embassy, but this is rare.

- If no solution is found: The bank will suggest closing the account and transferring the funds to another account in your name (often internationally, with fees).

Comparison with Other Thai Banks

Bangkok Bank is not the only one enforcing these restrictions. Here is an overview of the policies at major banks:

| Bank | Accounts for Tourists | Conditions for Foreigners |

|---|---|---|

| Bangkok Bank | ❌ No (since 2025) | Long-term visa mandatory, strict KYC |

| Kasikorn Bank (KBank) | ❌ Increasingly difficult | Often requires a work permit or student visa |

| Siam Commercial Bank (SCB) | ❌ Almost never | Long-stay visa or professional relationship |

| Krungsri (Bank of Ayudhya) | ⚠️ Rarely accepted | Long-term visa required, retirees sometimes accepted |

| Krungthai Bank | ⚠️ Limited possibility | Strict document requirements, sometimes more flexible in the provinces |

How to Avoid Future Account Freezes

To ensure uninterrupted access to your funds, the best approach is to be proactive. Make sure your situation always complies with the bank’s requirements. This includes holding a valid long-term visa and updating all your personal information as needed, especially your phone number.

Alternatives to Traditional Thai Banks

Faced with tightening conditions, many expats and digital nomads are turning to other solutions:

- Wise (formerly TransferWise): A multi-currency account with an IBAN, allowing you to easily receive and send money to Thailand.

- Revolut: A convenient online banking solution for paying in baht and holding multiple currencies without hidden fees.

- PromptPay: Requires a Thai bank account but can be linked to a local SIM card registered in your name.

- Offshore Banks / International Accounts: Can help manage finances and transfer funds to Thailand even without a local account.

The Key to a Secure Account: A Valid Long-Term Visa

Ultimately, having your Bangkok Bank account frozen isn’t a personal action against you—it’s a direct consequence of Thailand’s nationwide effort to secure its financial system. The core issue is almost always a visa type now deemed unsuitable, such as a tourist or DTV visa, under new anti-fraud regulations. The only reliable solution involves direct contact with your branch to prove you meet the new conditions. For all expats and long-term residents, ensuring your visa status is fully aligned with banking requirements is now crucial to avoid any disruption.

Frequently Asked Questions (FAQ)

Why is Bangkok Bank freezing foreigners’ accounts?

Bangkok Bank is freezing accounts to comply with new Thai regulations aimed at combating financial fraud, money laundering, and the use of “mule accounts” by criminals.

Are only Bangkok Bank customers affected?

No. Although Bangkok Bank is the most cited due to its size, these enhanced security measures are being adopted by all commercial banks in Thailand under the direction of the government and the Bank of Thailand.

Is my tourist visa or DTV sufficient to keep my account?

No. Under the new rules in effect since 2025, tourist visas, including the Destination Thailand Visa (DTV), are no longer considered sufficient. A long-stay visa (work, retirement, marriage, etc.) is required.

What should I do if I’m not in Thailand and my account is frozen?

This is the most complex situation. Most of the time, an in-person visit to the original branch is required for verification. It is advisable to contact the bank by phone to explore possible alternatives, but there is no guarantee that a remote solution is possible.

Will I lose my money if my account is frozen?

A freeze is a temporary restrictive measure, not a permanent closure with seizure of funds. The money remains in the account. You must regularize your situation to access it again. If you cannot meet the new requirements, the bank will inform you of the procedure to close the account and retrieve your balance.

🔄 Last updated on January 5, 2026

Oliver,

This is a very useful post and l am particularly interested because l am one of many with a frozen account and stranded in Hua Hin.

You mention that having a property in Thailand can be used to unfreeze the account. Is this in addition to the visa requirements or instead of?

Hello Channi,

Thanks for your message. Property can help as a supporting document to unfreeze an account, but it does not replace visa and KYC requirements—it’s usually in addition to them. Best to check with the branch on the exact documents they need in your case.

Hi Oliver,

I think my bank account got frozen as well. I opened it while living in Chiang Mai a year or so ago. However, for the last year I have been back to Russia and have no current plans to go back to Thailand. Do you think it is possible to unfreeze the account remotely by any means?

Is there some kind of option to forward documents through an agent or else?

Hi,

Unfortunately, the answer is quite direct: it’s almost impossible to unfreeze a Thai bank account remotely.

Banks in Thailand almost always require an in-person visit to the branch, often the one where you opened the account, with your passport. This is a security procedure to verify your identity (KYC) that not even a lawyer or an agent can do for you.

Your only remote option is to try calling your bank’s customer service to see if they have an exceptional procedure, but the chances are extremely low. The most realistic solution is to plan a trip to Thailand to sort it out personally.

I’m sorry I don’t have better news. Good luck.

Oliver

Hi,

Thanks a lot for your reply.

Do you think it is possible to at least transfer funds to a friends account and then close my account? Or that is not an option too?

Hi,

Thanks for following up. Unfortunately, that is also not an option.

When a bank account is “frozen,” all outgoing transactions are blocked. You cannot make transfers, withdrawals, or any other payments until the freeze is lifted. The purpose of the freeze is to prevent any movement of funds.

Attempting to transfer money to a friend’s account is impossible for two main reasons:

The block is technical: The bank’s system will not allow you to initiate the transfer.

Anti-Money Laundering (AML) rules: Transferring funds from a frozen account to a third party is a major red flag for banks. They will not authorize it.

The only way to retrieve your funds without unfreezing the account in person is to request a formal account closure. In that case, the bank will only transfer the balance to another account that is provably in your name, usually via an international SWIFT transfer, which will have fees. They will not transfer it to a friend’s account.

I’m sorry the options are so limited.

Best regards,

Oliver

So, basically they do not care if a person is unable to make a visit in person due to various reasons, like living in another country? It’s insane.

How long can the account stay frozen? Is there a case in which a bank can just arrogate funds without any notice? I wasn’t even officially informed about the closure.